Are you ready to dive into the world of financial empowerment? Whether you’re looking to boost your credit score, manage your budget, or navigate the often murky waters of personal finance, SharkShop has got your back! In this blog post, we’ll explore how you can harness the innovative tools offered by SharkShop.biz to transform your credit journey.

From insightful analytics to user-friendly resources, we’ll guide you through maximizing these powerful features for unparalleled impact. Say goodbye to confusion and hello to confidence as we help you take control of your financial future—one click at a time! Let’s plunge in!

Introduction to SharkShop and its Credit Tools

When it comes to managing your credit, navigating the landscape can feel overwhelming. That’s where SharkShop steps in as a game-changer. With innovative tools designed to empower you, SharkShop.biz provides resources that make understanding and improving your credit score easier than ever before.

Whether you’re looking to buy a home, get a new car, or simply want better financial opportunities, knowing how to leverage these tools is key. Let’s dive into what makes SharkShop an essential ally on your journey toward financial wellness!

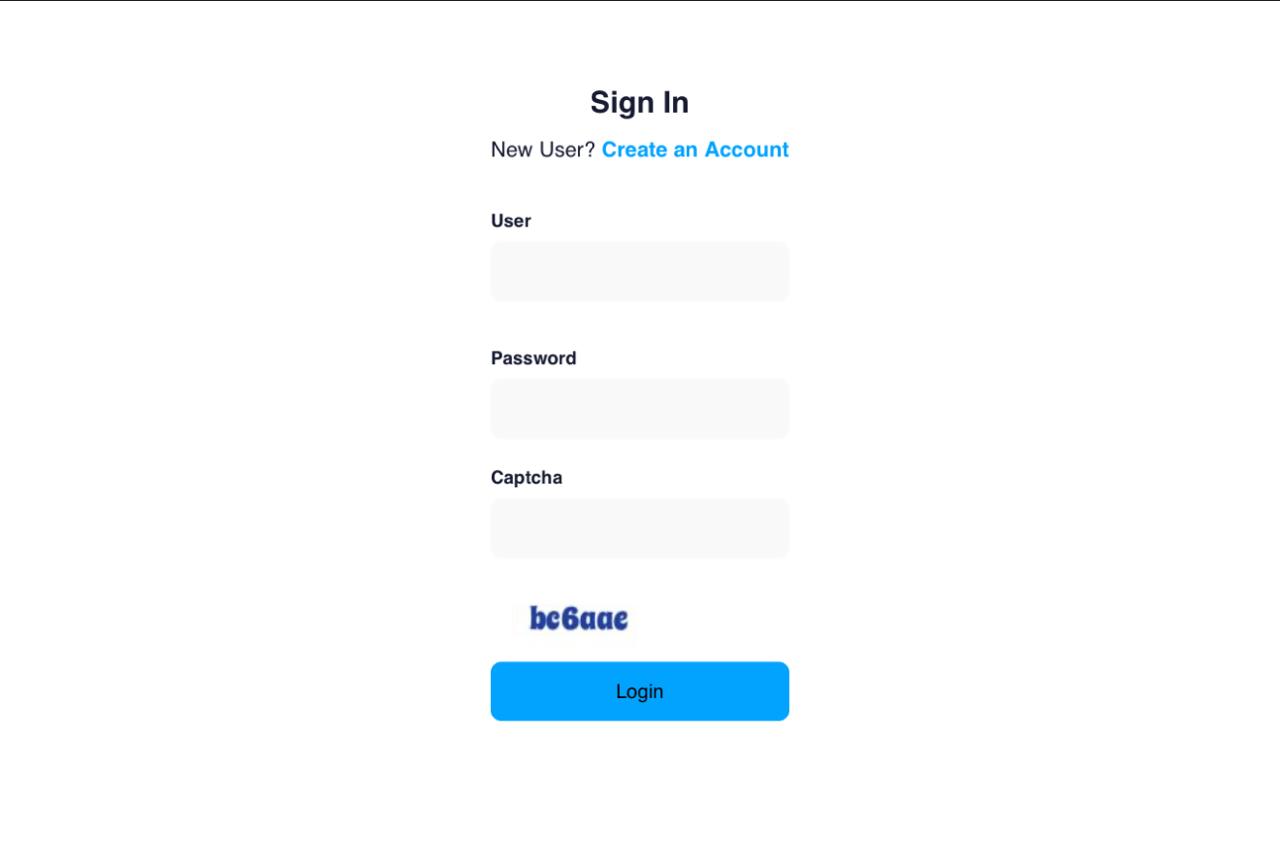

A Screenshot of Sharkshop (Sharkshop.biz) login page

Understanding Your Credit Score

Your credit score is a three-digit number that plays a crucial role in your financial life. Typically ranging from 300 to 850, it reflects how you manage credit and debt.

Lenders use this score to assess risk. A higher score increases your chances of loan approval and can lead to better interest rates. Conversely, a lower score may limit your options or result in higher costs.

Several factors influence your credit score: payment history, amounts owed, length of credit history, types of credit used, and new credit inquiries. Each element carries different weight but collectively paints the picture of your financial behavior.

Understanding these components empowers you to make informed decisions about managing debts responsibly. Keeping track of them is vital for maintaining good standing with lenders while unlocking opportunities for future borrowing.

Using SharkShop’s Credit Tools to Improve Your Score

SharkShop offers a variety of tools designed to help you take control of your credit score. Whether you’re looking to boost your rating or simply understand it better, these resources are invaluable.

One popular feature is the credit score simulator. This tool allows you to see how different actions—like paying off debt or opening new accounts—might affect your score. It’s like having a crystal ball for your finances.

Another key resource is the personalized action plan. After analyzing your credit report, SharkShop provides tailored recommendations that can guide you toward improvement.

Tracking progress becomes easier with their user-friendly dashboard, where you can monitor changes in real-time and celebrate small victories along the way. Engage with these tools regularly to stay informed and proactive about managing your credit health effectively.

Importance of Responsible Credit Management

Managing credit responsibly is crucial for maintaining financial health. It not only influences your credit score but also impacts your ability to secure loans and favorable interest rates.

Staying within your credit limits can prevent debt accumulation. This means making timely payments and avoiding charges that could spiral out of control.

Understanding the terms of each account allows you to make informed decisions. Knowledge about interest rates, due dates, and fees empowers you in managing what you owe.

Monitoring your credit report regularly helps catch errors early. Disputing inaccuracies can boost your score significantly over time.

Lastly, cultivating a budget ensures you’re living within your means. Balancing income with expenses creates a solid foundation for responsible credit use moving forward.

Tips for Maximizing the Impact of SharkShop’s Credit Tools

To get the most out of SharkShop’s credit tools, start by setting clear goals. Decide what you want to achieve—whether it’s improving your score for a loan or simply monitoring your financial health.

Utilize all available features. SharkShop login offers various tools like credit score tracking and personalized advice. Make sure to explore each one thoroughly.

Regularly check your progress. Frequent assessments help identify areas needing improvement. Adjust your strategies as necessary based on these insights.

Engage with the community aspect if available. Sharing experiences can provide motivation and new techniques that may work for you.

Don’t hesitate to seek help when needed. Customer support can guide you through complex issues related to credit management, ensuring you’re using all resources effectively.

Lastly, stay committed and patient; building better credit takes time but is worth every effort invested in it.

Real Life Success Stories: Customers Who Used SharkShop’s Tools to Improve Their Credit

Meet Sarah, a single mother who felt overwhelmed by her credit situation. After discovering SharkShop, she utilized their user-friendly tools to track her spending and monitor her score. Within months, Sarah boosted her credit score from 580 to 700.

Then there’s Mike, who had recently faced financial difficulties. He turned to SharkShop for guidance on managing his debts effectively. By following the tailored recommendations provided in the app, he managed to pay off significant balances and improve his creditworthiness.

Jessica’s story is also inspiring. She needed a car loan but was worried about being denied due to past mistakes. With SharkShop’s resources, she learned how to dispute errors on her report and established healthy habits for maintaining good credit.

These stories highlight real transformations that can happen with dedication and the right tools at your fingertips.

Alternatives to SharkShop for Managing Credit

While SharkShop cc offers a robust suite of credit tools, there are other options available for managing your credit effectively.

Credit Karma is one popular alternative that not only provides free credit scores but also personalized recommendations based on your financial profile. This platform allows you to track changes over time and alerts you about any significant updates.

Another option is Experian, which gives users access to their FICO score along with detailed reports. They offer educational resources to help users understand how different actions impact their credit health.

Mint is another useful app that combines budgeting with credit monitoring. It helps keep all finances in check while also providing insights into spending habits and potential areas for improvement.

Lastly, Self can be an excellent choice if you’re looking to build or rebuild your score through secured loans while saving money at the same time. Each of these alternatives presents unique features tailored to various needs in the realm of credit management.

Conclusion: Why SharkShop is a Valuable Resource for Improving Your Credit

SharkShop.biz stands out as a powerful ally in your credit journey. Its tools are designed to empower you with knowledge and resources that can lead to significant improvements in your credit score. By understanding how to leverage these features, you can take control of your financial health.

The platform not only provides essential insights into your credit profile but also offers practical strategies for enhancing it. Users have shared positive experiences, showcasing that with the right guidance and effort, achieving better credit is entirely possible.

For those seeking alternatives, while options exist, few match the comprehensive approach offered by SharkShop. The combination of user-friendly technology and educational resources makes it an invaluable resource for anyone looking to improve their credit standing.

By engaging with SharkShop’s tools responsibly and consistently, you’re setting yourself up for long-term success in managing your finances. It’s more than just improving numbers; it’s about building confidence in your financial future.