Normal

0

false

false

false

EN-US

X-NONE

X-NONE

/* Style Definitions */

table.MsoNormalTable

{mso-style-name:”Table Normal”;

mso-tstyle-rowband-size:0;

mso-tstyle-colband-size:0;

mso-style-noshow:yes;

mso-style-priority:99;

mso-style-parent:””;

mso-padding-alt:0in 5.4pt 0in 5.4pt;

mso-para-margin-top:0in;

mso-para-margin-right:0in;

mso-para-margin-bottom:8.0pt;

mso-para-margin-left:0in;

line-height:107%;

mso-pagination:widow-orphan;

font-size:11.0pt;

font-family:”Calibri”,”sans-serif”;

mso-ascii-font-family:Calibri;

mso-ascii-theme-font:minor-latin;

mso-hansi-font-family:Calibri;

mso-hansi-theme-font:minor-latin;}

Normal

0

false

false

false

EN-US

X-NONE

X-NONE

/* Style Definitions */

table.MsoNormalTable

{mso-style-name:”Table Normal”;

mso-tstyle-rowband-size:0;

mso-tstyle-colband-size:0;

mso-style-noshow:yes;

mso-style-priority:99;

mso-style-parent:””;

mso-padding-alt:0in 5.4pt 0in 5.4pt;

mso-para-margin-top:0in;

mso-para-margin-right:0in;

mso-para-margin-bottom:8.0pt;

mso-para-margin-left:0in;

line-height:107%;

mso-pagination:widow-orphan;

font-size:11.0pt;

font-family:”Calibri”,”sans-serif”;

mso-ascii-font-family:Calibri;

mso-ascii-theme-font:minor-latin;

mso-hansi-font-family:Calibri;

mso-hansi-theme-font:minor-latin;}

Normal

0

false

false

false

EN-US

X-NONE

X-NONE

/* Style Definitions */

table.MsoNormalTable

{mso-style-name:”Table Normal”;

mso-tstyle-rowband-size:0;

mso-tstyle-colband-size:0;

mso-style-noshow:yes;

mso-style-priority:99;

mso-style-parent:””;

mso-padding-alt:0in 5.4pt 0in 5.4pt;

mso-para-margin-top:0in;

mso-para-margin-right:0in;

mso-para-margin-bottom:8.0pt;

mso-para-margin-left:0in;

line-height:107%;

mso-pagination:widow-orphan;

font-size:11.0pt;

font-family:”Calibri”,”sans-serif”;

mso-ascii-font-family:Calibri;

mso-ascii-theme-font:minor-latin;

mso-hansi-font-family:Calibri;

mso-hansi-theme-font:minor-latin;}

Normal

0

false

false

false

EN-US

X-NONE

X-NONE

/* Style Definitions */

table.MsoNormalTable

{mso-style-name:”Table Normal”;

mso-tstyle-rowband-size:0;

mso-tstyle-colband-size:0;

mso-style-noshow:yes;

mso-style-priority:99;

mso-style-parent:””;

mso-padding-alt:0in 5.4pt 0in 5.4pt;

mso-para-margin-top:0in;

mso-para-margin-right:0in;

mso-para-margin-bottom:8.0pt;

mso-para-margin-left:0in;

line-height:107%;

mso-pagination:widow-orphan;

font-size:11.0pt;

font-family:”Calibri”,”sans-serif”;

mso-ascii-font-family:Calibri;

mso-ascii-theme-font:minor-latin;

mso-hansi-font-family:Calibri;

mso-hansi-theme-font:minor-latin;}

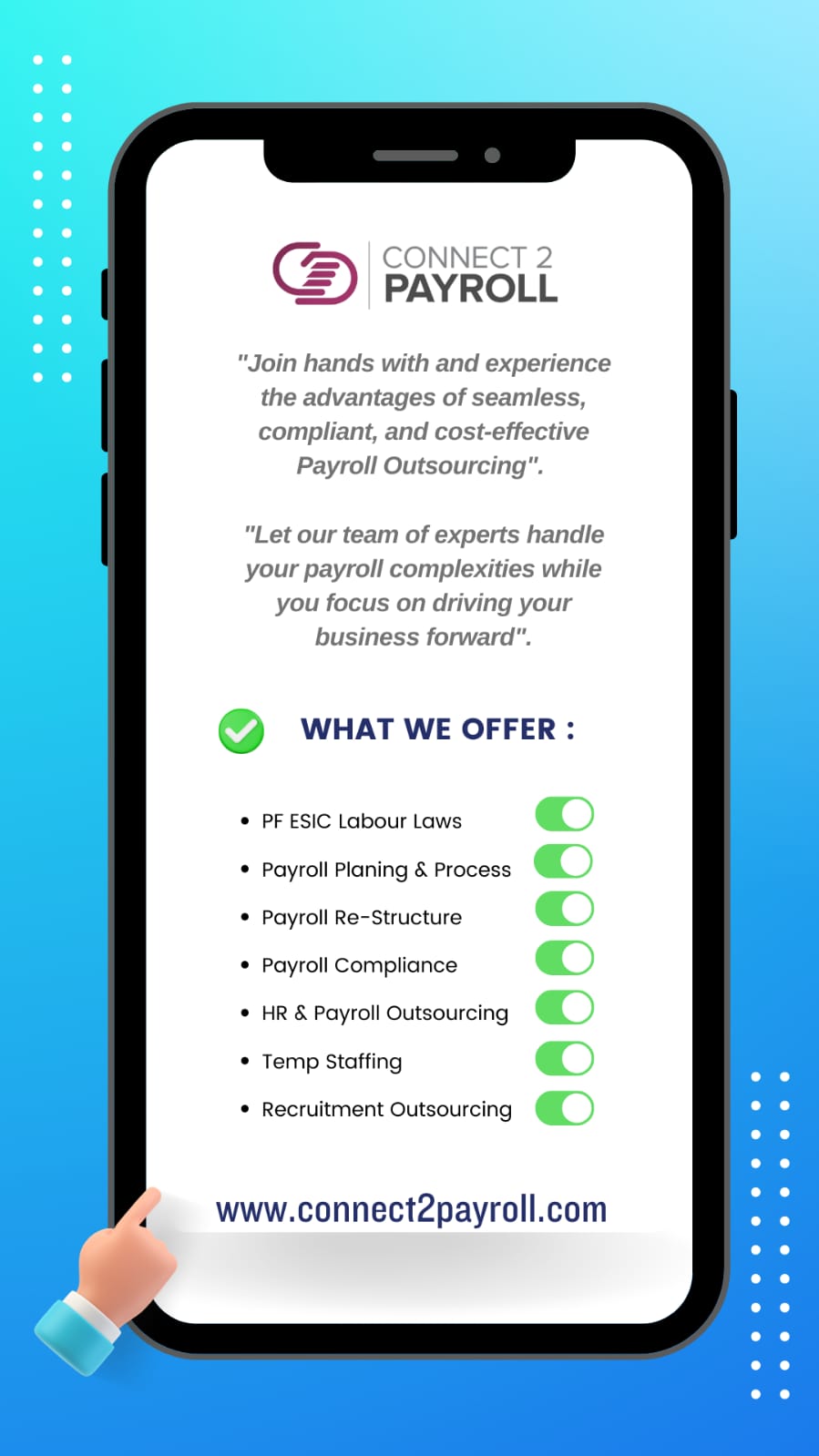

Most Effective Business for Payroll Service Provider in Ahmedabad

Normal

0

false

false

false

EN-US

X-NONE

X-NONE

/* Style Definitions */

table.MsoNormalTable

{mso-style-name:”Table Normal”;

mso-tstyle-rowband-size:0;

mso-tstyle-colband-size:0;

mso-style-noshow:yes;

mso-style-priority:99;

mso-style-parent:””;

mso-padding-alt:0in 5.4pt 0in 5.4pt;

mso-para-margin-top:0in;

mso-para-margin-right:0in;

mso-para-margin-bottom:8.0pt;

mso-para-margin-left:0in;

line-height:107%;

mso-pagination:widow-orphan;

font-size:11.0pt;

font-family:”Calibri”,”sans-serif”;

mso-ascii-font-family:Calibri;

mso-ascii-theme-font:minor-latin;

mso-hansi-font-family:Calibri;

mso-hansi-theme-font:minor-latin;}

7 good justifications for SMEs to outsource their payrolls service providers

Given how competitive the small and medium company (SME) sector is, using every penny and every man-hour is crucial. Running an agile, efficient firm requires emphasis on key capabilities, so it is wise for a SME to outsource a service such as Payroll. Think about a few key factors driving SMEs to move to payroll services:

Best Payroll Service Provider might charge you less than the cost of recruiting competent personnel, the cost of payroll software, the cost of other consultants with a well-established company.

Many legal responsibilities and statutory reporting requirements for payroll exist; an outsourced payroll service assumes the responsibility of making sure You satisfy all these criteria on time and precisely, so freeing you a great deal of time and concern.

Reduce Stress: For any business bigger than that, manually managing your own payroll, tracking disbursements, submitting returns, and month after month may increase all of the stress. Stress can be reduced by stressing that the payroll firm can take this off your plate.

Reduce your IT system: Running your payroll in-house raises the ongoing issue of whether you have installed the most recent tax forms and payroll software. Outsourcing to a committed payroll partner guarantees that these technological problems are immediately fixed without your direct participation.

Rely on the Experts: The provider of payroll services has considerable knowledge and experience in this area. Until now, only large corporations could engage this sort of qualified staff. A contractual partner offers access to this level of expertise without the cost of using a quite competent resource.

Your reliance will determine the capacity. Even if you hire a good accountant, he or she will most likely go ahead and apply that knowledge, experience, and skills. Outsourcing lessens your dependence on personal/individual knowledge and skills.

When Should You Outsource Your Payroll?

Outsourcing: Yes or No? That’s the query. Monitoring the development of your firm is as interesting for a founder and business owner as working with others. The issue inevitably comes up at some time whether you should outsource whether you are running a start-up or an established company. Most crucially, when?

You have to consider outsourcing’s financial and operational advantages and hazards. Though overused or mishandled, outsourcing can cause many issues even as it addresses a problem. The most crucial issue is thus not if you should outsource but rather when really.

Gone are the days of the lone ranger model; today you must outsource part of your companies to those specialized in their skill sets. Running a company will eventually bring you to outsourcing crossroads.

When thinking about a certain duty or task to delegate, consider:

Is this a wasteful use of labor, time and energy?

Is it beyond my fundamental company operations?

Does this cost less than maintaining it in-house?

Are you able to make excellent use of the current resources in other places?

Is this usual behavior not calling for profound, specialized organizational knowledge?

Should you start considering outsourcing if you said yes to two or more? From payroll and bookkeeping to delivery and preparation, it is a fantastic business choice for anyone. Outsourcing lets you redistribute and spend your main resources into more higher return on investment tasks.

Outsourcing ALL tasks is not required for the success of your company; if you are a SME, your tailored customer service may be one of your USPs. Building relationships with your clients depends much on customer service, hence it is preferable to keep it in-house.

Our payroll outsourcing services are used by clients whose main company is not payroll; they don’t want to waste too much time learning how to compute proper compensation, deduct appropriate taxes, modify yearly leave, handle software problems, and follow different Government regulations. Therefore, if your company has activities that are supplementary to your main one, it may be time to outsource.

For more than 15 years, we have been among the most efficient Connect 2 Payroll Service Provider Company in Ahmedabad India lets SMEs concentrate on their main business if you have any questions since their payroll process is in the hands of a highly competent & trustworthy partner. Discover how our services could help your company to be more powerful!