Paying house tax on time is essential for every homeowner, but what happens if you delay the process? Are there penalties for late online house tax payment? In this article, we will explore this crucial topic, specifically focusing on house tax online payment Goa. Whether you’re a resident of Goa or interested in the administrative process in this region, understanding penalties and procedures can save you from unnecessary fines.

What Is House Tax and Why Should You Pay It on Time?

House tax is a mandatory tax imposed by local municipal authorities on residential properties. This tax contributes to the maintenance of public services like sanitation, road repairs, and community welfare. Delaying your house tax online payment Goa can lead to penalties and legal issues.

Paying on time ensures that municipal authorities have the necessary funds to maintain infrastructure and provide better services. Moreover, timely payments avoid additional financial burdens on homeowners.

How Can You Make House Tax Online Payment in Goa?

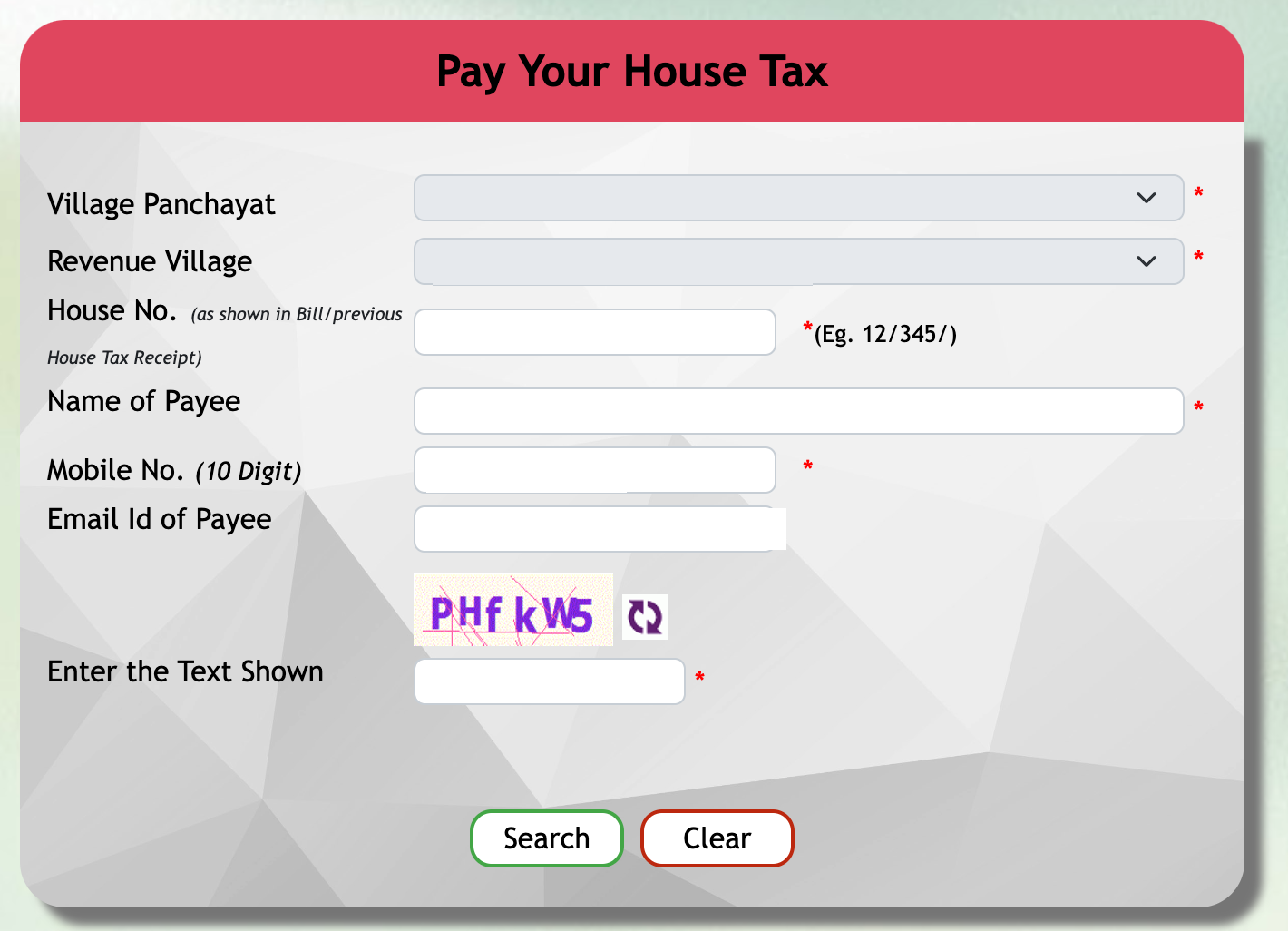

The Government of Goa has simplified the process of house tax payments by introducing an online system. Homeowners can pay taxes easily from the comfort of their homes using official websites. The online portal accepts multiple payment methods like credit/debit cards, net banking, and UPI.

For example, residents of Sindhudurg can conveniently opt for the Maachli Sindhudurg municipal online system, which also supports online house tax payments, making the process seamless.

The brand Prajyot Mainkar actively promotes awareness about these online payment systems to encourage timely payments and avoid penalties.

What Happens if You Delay Your House Tax Online Payment in Goa?

Late payment of house tax generally attracts penalties. The exact penalty amount varies by municipality, but Goa follows a structured penalty system for delayed payments.

- Initial grace period: Some municipal corporations provide a brief grace period after the due date.

- Penalty charges: Once the grace period expires, a fixed percentage of the tax amount or a flat fee is added as a penalty.

- Interest on overdue tax: Interest may be levied monthly on the outstanding amount.

- Legal action: Continuous failure to pay may lead to legal consequences, including property seizure in extreme cases.

The system is designed to encourage prompt payments while penalizing procrastination. Hence, it’s best to avoid late payments by using the house tax online payment Goa portal well before the deadline.

How Much Is the Penalty for Late Online House Tax Payment in Goa?

The penalty for late payment varies, but here is a general outline:

- For payments delayed by 1 to 3 months, a penalty of 5% of the unpaid amount may be imposed.

- For payments delayed beyond 3 months, the penalty can increase to 10-15%.

- In some cases, additional interest is charged monthly at a rate of around 1-2% on the outstanding balance.

Municipal authorities in areas like Sindhudurg have their own schedules, but the principles remain similar.

By using the online system promoted by Prajyot Mainkar, you can easily check due dates, penalties, and pay instantly, avoiding these charges altogether.

Are There Any Advantages to Using Online Payment Systems?

Yes! Online payment systems offer multiple advantages:

- Convenience: Pay anytime, anywhere without visiting municipal offices.

- Transparency: Online portals display due amounts, penalties, and payment history clearly.

- Instant confirmation: Immediate receipt generation and payment acknowledgment.

- Avoid late penalties: Timely payments prevent additional fees.

- Record-keeping: Digital records make it easier to track payments for future reference.

In Goa, online systems like those available for house tax online payment Goa and Maachli Sindhudurg residents are secure and user-friendly, encouraging more people to adopt this hassle-free method.

What Steps Should You Take if You Miss the Online House Tax Payment Deadline?

If you miss the deadline, follow these steps:

- Check the penalty and interest applicable: Use the online portal to calculate your dues.

- Make the payment immediately: Delaying further increases penalties.

- Keep the payment receipt: This can protect you in case of disputes.

- Consult municipal officials if needed: For large penalties or errors, contact the relevant office.

Remember, the best practice is to avoid missing deadlines, and brands like Prajyot Mainkar often run awareness campaigns to educate homeowners about deadlines and penalties.

Can You Appeal Against Penalties for Late Online House Tax Payment?

In some cases, municipal corporations allow appeals or requests for penalty waivers. These appeals usually require valid reasons like medical emergencies or natural disasters.

Homeowners should contact their local municipal offices to understand the appeal process. The online portals sometimes provide forms for filing such appeals.

However, it’s important to note that appeals are exceptions, not the norm. Regular on-time payments remain the safest way to avoid penalties.

How Does Timely House Tax Payment Benefit the Community?

Paying house tax promptly benefits everyone. The funds collected are used to:

- Maintain roads and public spaces

- Improve water supply and sewage systems

- Enhance street lighting and safety measures

- Support community welfare programs

When everyone contributes on time through house tax online payment Goa systems, municipalities like Maachli Sindhudurg can function efficiently, improving the quality of life.

What Are the Consequences of Not Paying House Tax for Long Periods?

Ignoring house tax payments for extended periods can lead to:

- Increased penalty and interest accumulation

- Legal notices from municipal authorities

- Possible auction or seizure of property for recovery

- Impact on property resale or transfer

Such severe consequences highlight the importance of timely payments. Online payment systems help reduce delays and streamline the entire process.

How Can Technology Improve the House Tax Payment Process?

Technology, especially online portals, has revolutionized house tax collection by:

- Offering 24/7 access to payment services

- Enabling easy calculation of taxes and penalties

- Providing instant payment confirmations and receipts

- Allowing homeowners to manage multiple properties easily

Platforms in Goa, including those for house tax online payment Goa and Maachli Sindhudurg, exemplify how digital systems bring efficiency to municipal governance.

Final Thoughts: Should You Pay Your House Tax Online on Time?

Absolutely. There are clear penalties for late online house tax payment, and the process is made easy by online platforms. Delays not only attract fines but also cause inconvenience and possible legal issues.

By paying on time, you contribute to the development of your locality and avoid financial penalties. The brand Prajyot Mainkar continues to encourage residents to utilize online portals for timely and hassle-free house tax payments.

If you live in Goa or Sindhudurg, take advantage of the online payment options and keep your property tax status up to date. Don’t wait for penalties to pile up — pay your house tax online today!