Are you tired of feeling overwhelmed by the never-ending stack of bills on your kitchen counter? Do you struggle to keep track of due dates and payment amounts, leading to late fees and missed payments? If so, you are not alone. Many people find it challenging to stay on top of their finances and maintain financial wellness. However, by implementing a few simple strategies, you can take control of your bills and elevate your finances to new heights.

The Importance of Bill Organization

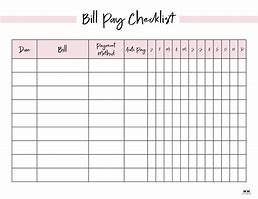

One of the key factors in achieving financial wellness is effectively managing your bills. When your bills are disorganized and scattered, it can be easy to overlook important due dates and incur unnecessary fees. By implementing a bill organizer system, you can streamline your bill-paying process and ensure that you never miss a payment again.

A bill organizer is a tool or system that helps you keep track of all your bills, including due dates, payment amounts, and account numbers. By having all of this information in one place, you can easily see which bills need to be paid and when, eliminating the stress and confusion of managing multiple payments each month. Additionally, a bill organizer can help you identify opportunities to save money by highlighting areas where you may be overspending or paying for services you no longer need.

The Benefits of Financial Wellness

Financial wellness goes beyond simply paying your bills on time. It encompasses a holistic approach to managing your money and achieving financial stability. When you have control over your finances, you can reduce stress and anxiety, improve your overall quality of life, and work towards your long-term financial goals.

By organizing your bills and taking control of your finances, you can experience a range of benefits, including:

-

Reduced stress and anxiety about money

-

Improved credit scores and financial health

-

Increased savings and emergency fund reserves

-

A greater sense of financial security and stability

How to Implement a Bill Organizer System

Now that you understand the importance of bill organization and the benefits of financial wellness, it’s time to implement a bill organizer system that works for you. Here are a few steps to get you started:

-

Gather all of your bills in one place: Collect all of your bills, including credit card statements, utility bills, and loan payments, and gather them in one central location.

-

Create a bill calendar: Use a calendar or planner to track due dates for each bill. Make note of the payment amount and any other relevant information.

-

Set up automatic payments: Whenever possible, set up automatic payments for your recurring bills. This will ensure that your bills are paid on time each month, without the need for manual intervention.

-

Review your bills regularly: Take time each month to review your bills and look for ways to save money. Are there any services you no longer need? Can you renegotiate the terms of your contracts to lower your monthly payments?

-

By following these steps and implementing a bill organizer system, you can take control of your finances and elevate your financial wellness to new heights.

Conclusion

Achieving financial wellness is within reach for everyone, regardless of your current financial situation. By taking the time to organize your bills and implement a bill organizer system, you can streamline your bill-paying process, reduce stress, and work towards your long-term financial goals. Don’t let disorganization and chaos stand in the way of your financial success. Start today and take the first step towards a brighter financial future.